Comprehending the Expense Savings of Medicare Advantage Insurance Policy

As people browse the complicated landscape of health care insurance coverage choices, understanding the subtleties of price financial savings within Medicare Benefit plans ends up being significantly essential. The potential economic advantages that these plans offer can dramatically affect an individual's medical care costs, offering a cost-effective choice to standard Medicare coverage. By diving into the intricacies of just how Medicare Advantage intends accomplish these savings, people can gain beneficial insights right into enhancing their medical care protection while possibly decreasing out-of-pocket expenditures. Beyond the surface-level contrasts, discovering the hidden elements driving these price savings introduces a realm of opportunities that can enhance both monetary health and access to top quality care.

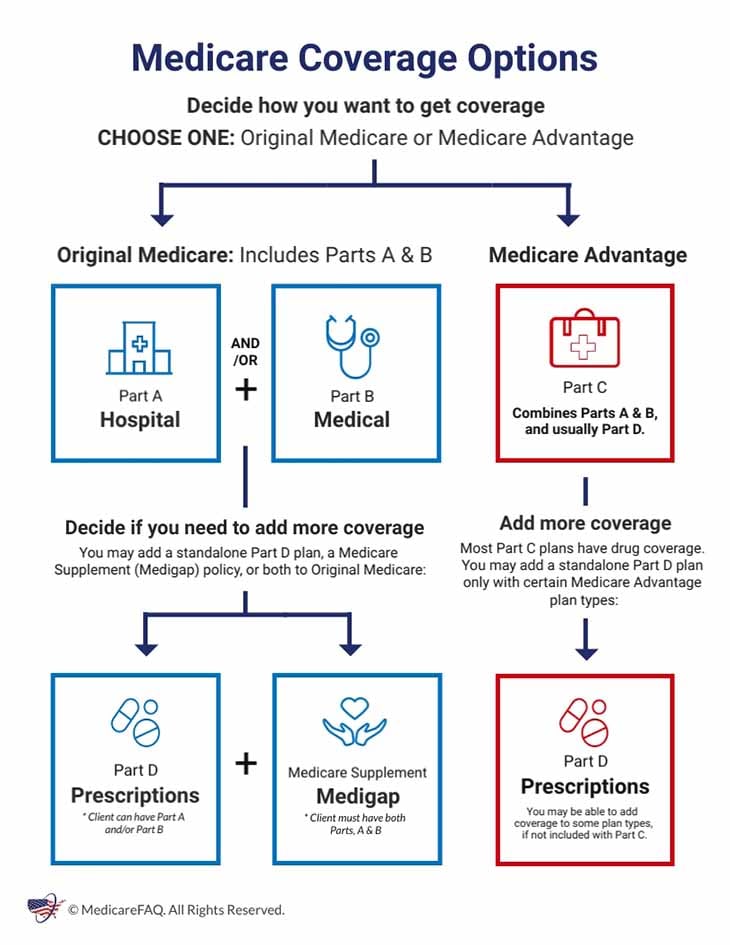

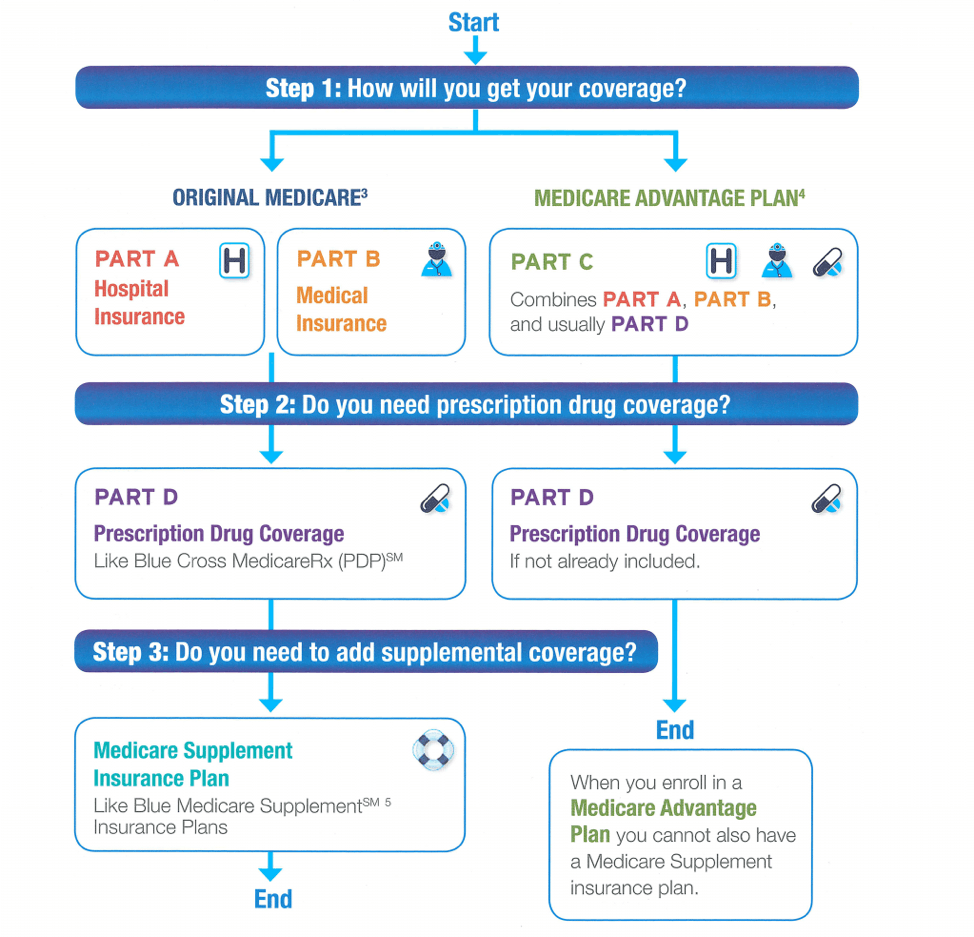

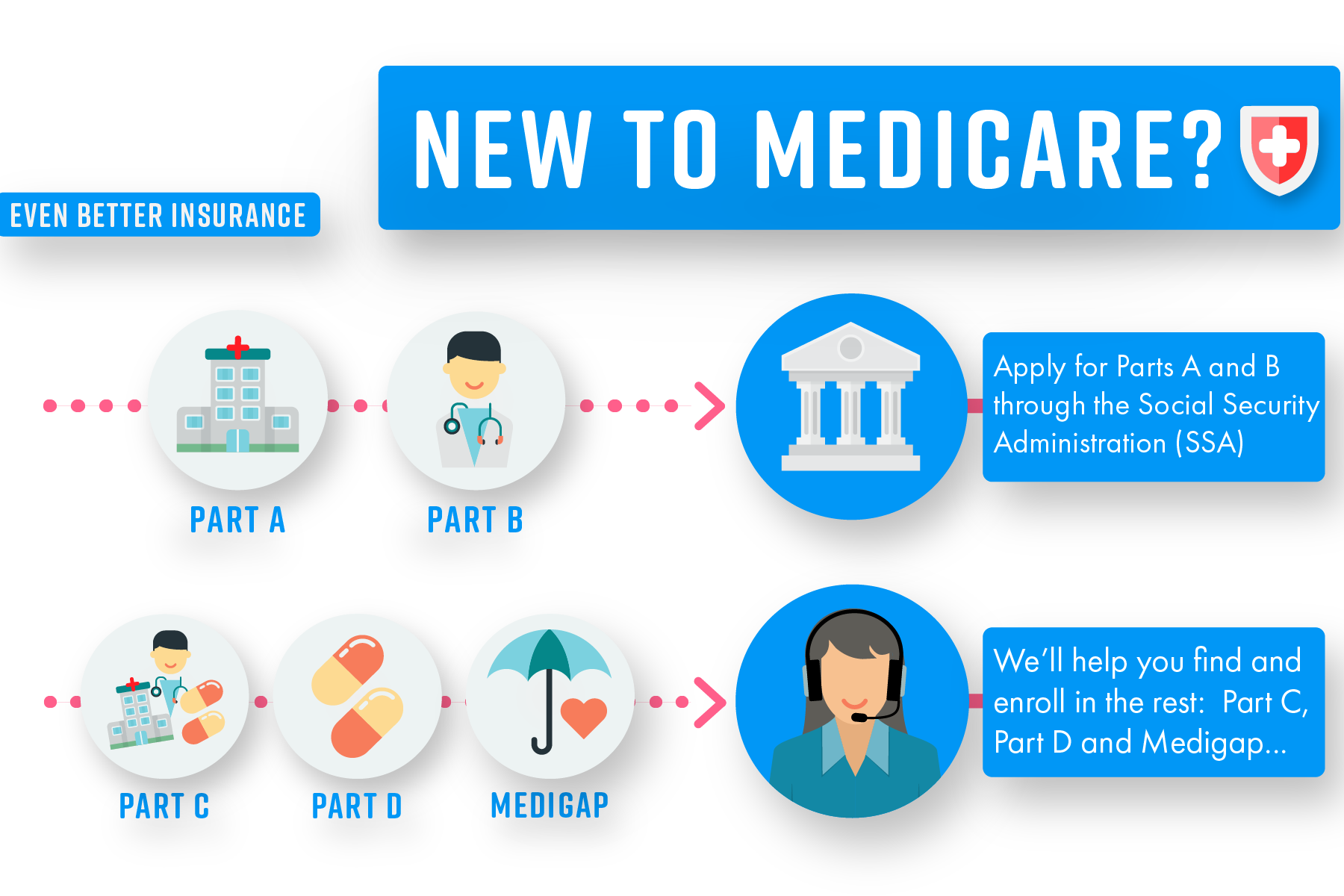

Advantages of Medicare Advantage Plans

Medicare Benefit intends offer a detailed selection of benefits that surpass standard Medicare insurance coverage, giving enrollees with improved medical care solutions and cost-saving opportunities. These plans often include protection for solutions such as dental, vision, hearing, and prescription medicines, which are not normally covered under initial Medicare. By settling these numerous healthcare requires into one strategy, Medicare Benefit recipients can delight in the benefit of having all their medical services covered under a solitary plan.

Additionally, Medicare Advantage plans frequently incorporate extra advantages like health club subscriptions, telehealth solutions, and health care to advertise preventative care and overall wellness. These value-added advantages intend to boost the top quality of treatment for enrollees while additionally assisting them minimize out-of-pocket costs that they may otherwise incur with traditional Medicare.

In significance, the advantages of Medicare Benefit intends expand past fundamental medical coverage, offering a more holistic method to healthcare that focuses on safety nets, benefit, and cost-effectiveness for beneficiaries.

Affordable Protection Options

The enhanced advantages given by Medicare Benefit intends not just enhance health care coverage yet likewise present beneficiaries with a variety of affordable insurance coverage choices to think about. These plans frequently consist of additional advantages past Initial Medicare, such as vision, oral, hearing, and prescription drug insurance coverage, all bundled right into one detailed package (Medicare advantage plans near me). By supplying these extra solutions, Medicare Advantage strategies can help people save cash by reducing out-of-pocket costs that would certainly otherwise be sustained individually

In Addition, some Medicare Advantage strategies have reduced regular monthly costs compared to typical Medicare, making them an appealing alternative for those wanting to handle their healthcare expenses properly. The economical coverage choices readily available with Medicare Benefit strategies can offer recipients with comprehensive health care coverage while potentially conserving them money in the lengthy run.

Potential Out-of-Pocket Cost Savings

Additionally, Medicare Benefit plans commonly consist of fringe benefits not covered by Initial Medicare, such as vision, oral, hearing, and prescription drug insurance coverage. By packing these services into one comprehensive strategy, recipients can conserve cash on out-of-pocket costs that would or else be incurred if they had to acquire separate insurance policy policies or pay for services out of pocket.

Value-added Providers and Benefits

Value-added services and advantages given by Medicare Benefit prepares improve the overall healthcare experience for plan members. These added solutions go beyond what Original Medicare covers, providing extras such as vision, dental, hearing coverage, fitness programs, and even prescription medicine protection sometimes. By integrating these auxiliary advantages, Medicare Benefit prepares purpose to offer extensive treatment that addresses not just clinical over at this website requirements but additionally general wellness.

Moreover, some Medicare Benefit plans may supply telehealth services, which have come to be progressively valuable in today's electronic age. This allows plan participants to seek advice from doctor from another location, saving money and time while making sure accessibility to required clinical interest. Medicare advantage plans near me. In addition, numerous strategies offer treatment control solutions, aiding members browse the complexities of the medical care system and ensuring they get appropriate and timely treatment

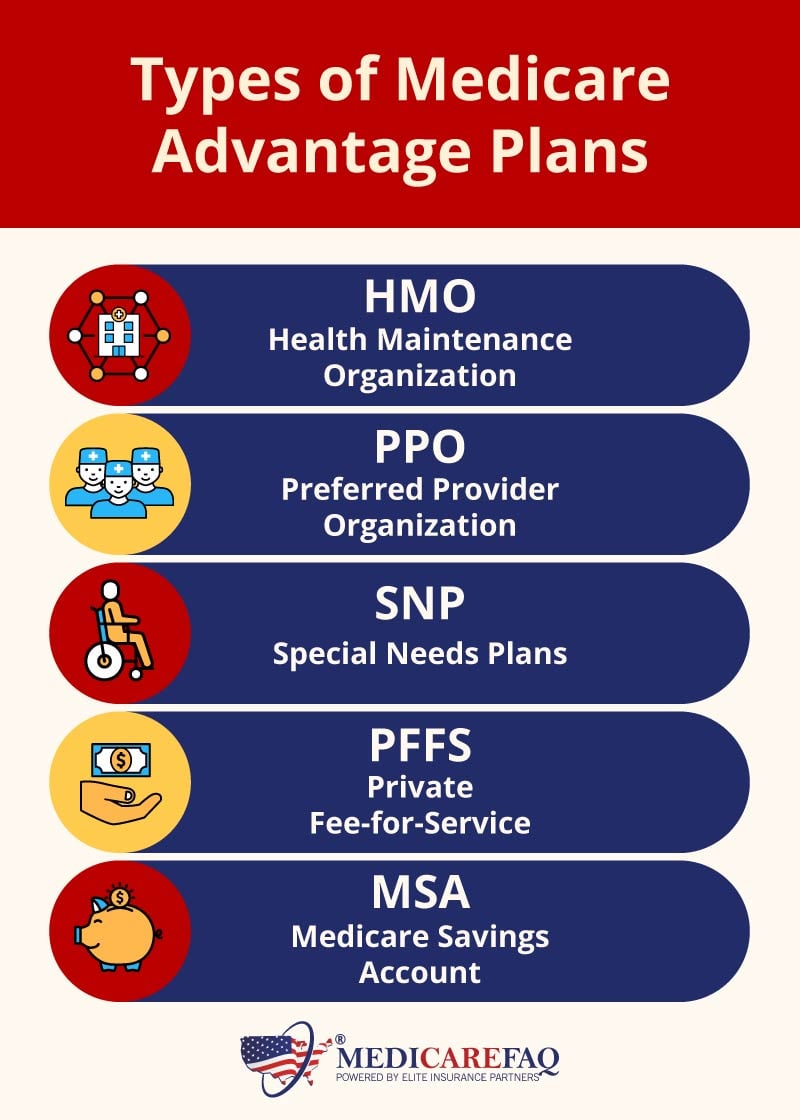

Elements Affecting Cost Financial Savings

Elements affecting cost financial savings within Medicare Advantage strategies are necessary to recognize for both suppliers and beneficiaries. One vital aspect adding to cost savings is the focus on preventative care and care sychronisation in Medicare Benefit strategies. By concentrating on precautionary solutions, such as testings and wellness check outs, these strategies intend to detect and deal with health and wellness concerns early on, ultimately minimizing the demand for pricey therapies or hospitalizations. Another element is the network structure of Medicare Advantage prepares, which commonly have agreements with details healthcare service providers to provide services at worked out rates. This network configuration can cause set you back financial savings contrasted to standard Medicare fee-for-service versions, where useful content expenses might be higher because of less controlled usage of services. Additionally, Medicare Advantage plans might supply motivations for recipients to utilize in-network suppliers, additionally advertising affordable care delivery. Recognizing these variables can aid carriers and recipients make notified decisions to optimize cost savings while keeping top quality treatment within Medicare Advantage plans.

Final Thought